Am i able to use a personal loan to consolidate existing debts? Should you have a variety of charge cards and retailer card debts, with a number of repayments to juggle, consolidating them into just one area with a personal loan could enable you to to control your repayments extra effectively.

Must I get a private loan or maybe a bank card? That is dependent on Each individual particular person’s situations and affordability When picking personalized loans or credit cards. You must study equally prior to deciding to choose what is true to your instances, but here are a few factors to think about:

Would like to make an application for a loan from 118 118 Cash? You are able to check out our eligibility Check out initial to discover should you’ll be recognized before you decide to implement – and it gained’t affect your credit rating ranking.

9% APR. Exactly what are the different types of loan? Private loans could be taken to buy such things as personal debt consolidation, vehicle repairs or producing household advancements. But each variety of loan can be distinguished by the type of attributes it has. We’ve listed some examples of these options below:

Variable price private loans Variable fee private loans are accurately that – personal loans with an interest rate which may vary more than the period of the private loan.

Bank cards undoubtedly are a revolving line of credit history, so if you pay back your equilibrium, You can utilize it yet again.

There are various actions that could induce this block like submitting a particular term or phrase, a SQL command or malformed knowledge.

Payday loans do tend to possess a significant curiosity price since they are aimed at Those people with terrible or inadequate credit.

A Personal debt Administration Strategy (DMP) can be a personal debt Answer used to support people today repay their debts at An inexpensive charge agreed by your creditors.

It all arrives all the way down to your ability to repay the loan based upon what you explain to us, how well you’ve managed credit score in advance of, your financial profile, and exactly what the credit rating agencies inform us. Accordingly, it’s in your very best fascination to accomplish your software form as precisely as it is possible to.

Mounted fee vs. variable price Whether your own loan charge is preset or variable will rely on your lender and what merchandise they have got offered. That may help you recognize the real difference, we have summarised:

Should you repay part of the loan early, this will likely lessen the complete loan amount and could reduce future payments, meaning you might pay back less All round also.

If only the least payment is repaid around the owing date, then the stability will have fascination applied to it. It’s also value Given that with bank cards some lenders may additionally provide added incentives for example loyalty factors or air miles with each invest in as well. more info A aspect you’re unlikely to seek out with a private loan.

Certainly. We’re serious about being familiar with why you may want a loan, however, you may possibly use the money nevertheless you would like.

Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Michael C. Maronna Then & Now!

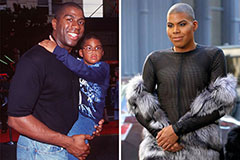

Michael C. Maronna Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now!